Your Journey Starts Here

Home Stability With Rent Assure™

Our Rent Assure Program provides essential support to help you maintain stable housing and manage financial challenges with three core services:

Rental Assistance

Our Rental Assistance service is designed for individuals facing difficulty making rent payments. We provide timely financial support to help cover overdue or upcoming rent.

Mortgage Relief

The Mortgage Relief service offers vital assistance for homeowners struggling to meet their mortgage payments. We work directly with lenders to arrange relief options, helping you avoid adverse action.

Security Deposit Payment

Our Security Deposit Payment service helps ease the financial burden by covering the security deposit needed for your new apartment.

- Impacted over 1,000+ satisfied households!!!

how it works

Application and Review Process

Complete our quick, 2 minute application for assistance. Apartazza reviews your information.

Approval

Get notified of your application approval.

Payment

Your relief payment is deposited for payment to your Landlord.

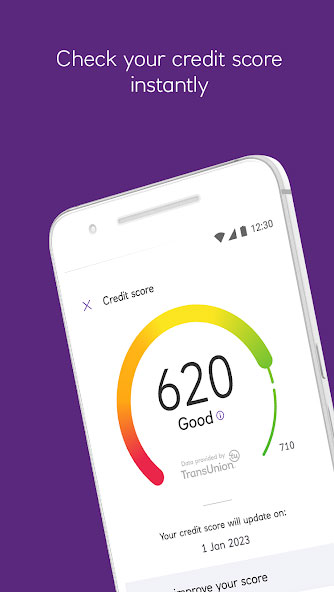

The Power Of Your Score

The credit score comparison when financing a $35,000 automobile of 36 months.

RYAN

- Credit score

- 600

- Interest rate

- 13.18%

- Down Payment Required

- Yes

DEREK

- Credit score

- 740

- Interest rate

- 6.87%

- Down Payment Required

- No

Derek saves over $6,200+ in total payments made thanks to a stronger credit score!

Please note that financing rates and prices are subject to change regularly, and the comparison provided is for illustrative purposes only.

Improve Score With Credit Restore™

Our Credit Restore Program is designed to help you understand, improve, and take control of your credit with three core services:

Credit Education

Gain the knowledge you need to make smart financial decisions. Our Credit Education service provides personalized resources, expert insights, and tips on credit management.

Credit Repair

If your credit score needs improvement, our Credit Repair service can help. Our experienced team is dedicated to work on your behalf to identify and dispute inaccuracies, negotiate with creditors, and remove negative items where possible.

DIY Credit Repair

Prefer to handle credit repair on your own? Our DIY Credit Repair service gives you a step-by-step breakdown, empowering you to repair your credit independently at your own pace.

Empower Future With Credit Secure™

Our Credit Secure Program is designed to enhance your credit profile and build a strong financial future with three key services:

Tradelines

Our Tradeline service helps boost your credit score by leveraging authorized user accounts with strong credit histories and lines of credit,

Payment Reporting

With our Payment Reporting service, we help you build your credit history by reporting your timely payments for rent, utilities, and other recurring bills to credit bureaus.

Secured Debit/Credit Cards

Our Secured Card service provides a great option for building or rebuilding credit with low deposit and interest that reports to the credit bureaus.